Let’s be honest. Running a subscription business feels less like a sprint and more like tending a garden. You’re not just chasing a one-time sale; you’re nurturing a relationship, hoping your customers stick around, bloom, and maybe even spread seeds. And the financial side? It’s the soil and sunlight of that whole operation. Get it wrong, and things wilt. Get it right, and you get sustainable, predictable growth.

That’s the deal with financial planning and reporting for subscription models. Traditional accounting methods, built for one-and-done transactions, just don’t cut it. You need a different lens—one focused on the long game. So, let’s dive into what makes this financial world tick, and how you can master it.

Why Subscription Finance Feels Different (It Is)

In a traditional business, revenue recognition is pretty straightforward. Sell a widget, book the revenue. Done. Subscription revenue recognition, though, is a whole other beast. You’re collecting cash upfront for a service delivered over time—a month, a year, maybe longer. This creates a fundamental disconnect between cash in the bank and revenue on the books.

You see, that annual payment you just landed? It’s not all “profit” today. It’s deferred revenue, a liability on your balance sheet. You earn it bit by bit as you deliver your service. This matching principle is crucial. It stops you from overspending based on a cash surge and gives you a true picture of profitability. Honestly, it’s the first big mindset shift.

The Core Metrics: Your North Star

Forget just tracking total sales. Subscription success is measured in a specific, sometimes quirky, set of KPIs. These are your vital signs.

MRR/ARR: The Heartbeat

Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) is your predictable income engine. It’s the lifeblood. Watching this number grow—and understanding why it grows—is job one. Did it go up from new customers? Upgrades? Or is it leaking from cancellations?

Churn: The Silent Leak

If MRR is the heartbeat, churn is the arrhythmia. Customer churn (how many leave) and the more telling revenue churn (how much money leaves) can sink you. A high growth rate can mask a churn problem for a while, but it’s like filling a bucket with a hole in the bottom. You’ll eventually tire out.

CAC and LTV: The Value Equation

This is the big one. Customer Acquisition Cost (CAC) is what you spend to get a customer. Lifetime Value (LTV) is the total revenue you expect from them. The rule of thumb? Your LTV should be at least 3x your CAC for a healthy model. If you’re spending more to acquire a customer than they’re worth… well, you know that’s not a recipe for longevity.

Building a Financial Plan That Actually Works

Planning here isn’t about static annual budgets. It’s a dynamic, rolling forecast. You’re modeling based on those key metrics. Here’s how to think about it.

1. Start with the Metrics, Not Guesses

Base your projections on real drivers: How many sign-ups do you expect per month? What’s your expected churn rate? What’s the plan for pricing changes or new tiers? This driver-based approach is way more accurate than just slapping a “10% growth” on last year’s numbers.

2. Cash Flow is King (Even with Recurring Revenue)

This trips up so many founders. You can have great MRR and still go bankrupt if your cash flow timing is off. Those upfront annual payments are fantastic for cash, but you have to resist the urge to spend it all. You need to model your cash flow statement meticulously, accounting for the lag between spending on marketing/salaries (now) and recognizing the revenue (over time).

3. Plan for the Layers

Your costs aren’t monolithic. You have:

- Cost of Goods Sold (COGS): Direct costs to serve each subscriber (like hosting fees, payment processing).

- Customer Acquisition Costs (CAC): All sales and marketing spend.

- General & Administrative (G&A): The overhead to keep the lights on.

Your plan should show how these scale—or don’t—as you add customers. Good gross margins (Revenue minus COGS) are essential; it’s what’s left to cover acquiring and serving your customers.

Reporting: Telling the Story Behind the Numbers

A P&L alone is a blurry snapshot. You need a dashboard. Think of it as the control panel for your garden, showing moisture, sunlight, and growth rates all at once.

| Core Report | What It Tells You | The “So What?” |

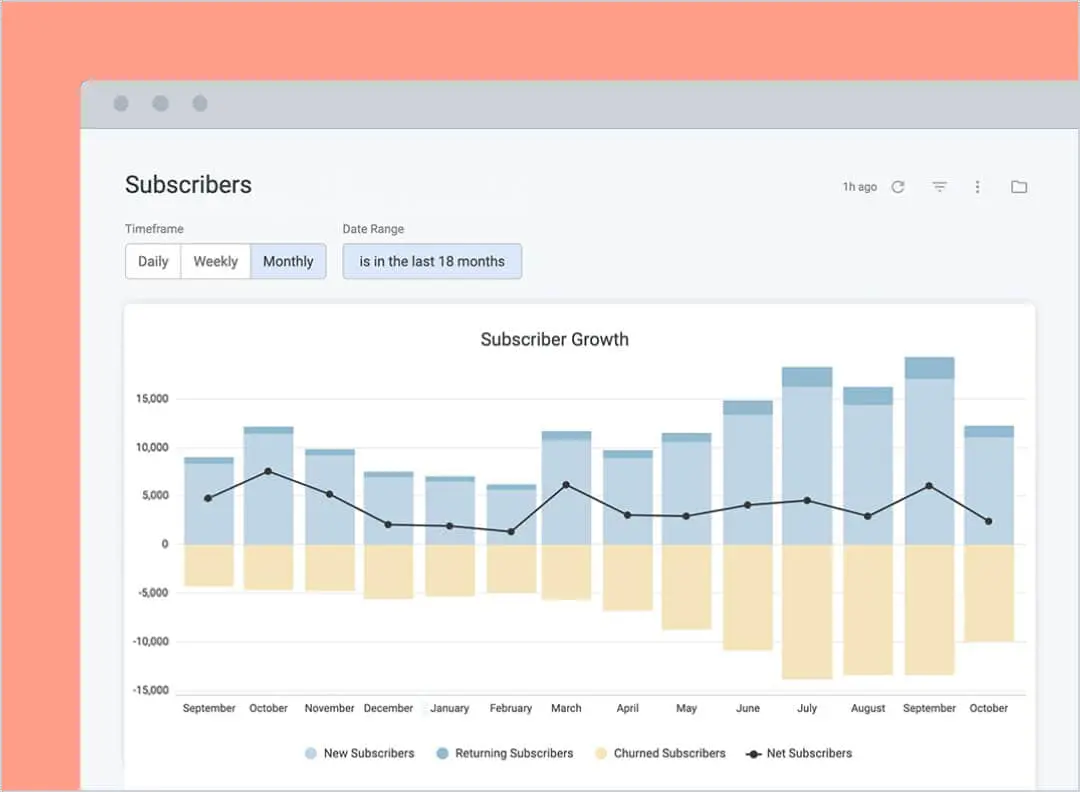

| MRR Movement Report | Breaks down MRR changes: New, Upgrades, Downgrades, Churn. | Are you growing from healthy expansion or just new sign-ups? Is churn concentrated in a specific plan? |

| Cohort Analysis | Tracks groups of customers who signed up in the same period over their lifetime. | Are newer cohorts more valuable (better LTV) or do they churn faster? This reveals product/market fit trends. |

| LTV:CAC Dashboard | Plots these two metrics over time, by channel. | Which marketing channels bring the most profitable, long-term customers? Where are you wasting money? |

| Cash Flow Forecast | Projects cash in/out 12-18 months forward. | When will you need to raise money? Can you afford that new hire now? |

The goal here is insight, not just data. Why did churn spike last month? Did that feature launch actually increase upgrade MRR? Your reports should spark these questions—and help answer them.

Common Pitfalls (And How to Sidestep Them)

Okay, let’s get real about where things go wrong. First, ignoring deferred revenue. Spending that annual cash like it’s pure profit is the fastest path to a crisis. Second, over-indexing on vanity metrics. A big total user number is cool, but if they’re all on a free trial and never convert, it’s meaningless. Focus on recurring metrics.

And third—this is a big one—not investing in the right tools. Spreadsheets are great to start, but they break. They’re manual, error-prone, and can’t handle real-time metric calculations at scale. Using a dedicated subscription analytics platform or a financial model built for SaaS isn’t an expense; it’s a necessity for clear vision.

The Bottom Line: It’s About Sustainability

In the end, financial planning and reporting for a subscription business isn’t just bean-counting. It’s the framework for building something lasting. It forces you to think in cycles, in relationships, in the long-term health of your customer base. It turns guesswork into guidance.

When you truly understand the flow of your revenue, the cost of your growth, and the lifetime value of your relationships, you’re not just surviving month-to-month. You’re cultivating a business that can weather seasons, adapt, and thrive for years to come. And that’s the whole point, isn’t it?